million dollar life insurance policy payout

A 1 million term life insurance policy has lower premiums than a whole life insurance policy worth the same amount. A 40-year-old non-smoking female can pay under.

How Much Is Life Insurance In Canada Average Costs Policyme

Financial experts suggest that you purchase a life insurance policy that is worth 5-15 times your annual income.

. As you can see blending a whole life policy with term insurance can reduce costs significantly. Overall million-dollar life insurance policies can be on the low-cost side depending on your situation. A one million dollar life insurance payout provides a quick infusion of tax-free money to pay off bills and estate taxes.

Ad Get Instantly Matched with Your Ideal Life Insurance Policy. Apply and sign up for SBLI Term Life no medical exam for up to 750k in coverage. Up to 150000 in coverage.

There are many things that are factored in to consider the cost of a million-dollar life insurance policy. 5 Million Dollar Life Insurance Policy. Ad Find out what your policy is worth.

In fact most Americans think a term life policy costs triple or more the actual cost. Apply and sign up for SBLI Term Life no medical exam for up to 750k in coverage. Learn how with our free info kit.

Compare 2022s Best Options. A million-dollar whole life policy often costs 800 a month or more even if you purchase the. Its possible to purchase policies with payouts.

In the previous example prices went. Ad Term life insurance is simple with SBLI. Ad Term life insurance is simple with SBLI.

Get An Instant Decision. Find the Best Rates Quotes for Life Insurance Policies Using Our Chart. A BBB Rated Providers.

Taken over the 15 insurance companies shown above the average cost for 20 years of coverage was. Get an instant estimate. Million dollar insurance just means that the payout your beneficiary will receive is one million dollars.

Compare Plans For Free Online. Monthly premiums can range from as low as 30 to as high as the. Ad Your life insurance is a valuable financial asset that can be turned into cash.

A million-dollar whole life policy is possible but is often much more expensive. Our Simple Process Allows You To Shop Top Rated Insurers And Save In Minutes. How does this apply to life insurance.

The cost of a million dollar life insurance policy will depend mostly. Get a quote online for 500k in coverage today. 10 million dollar life insurance best million dollar life.

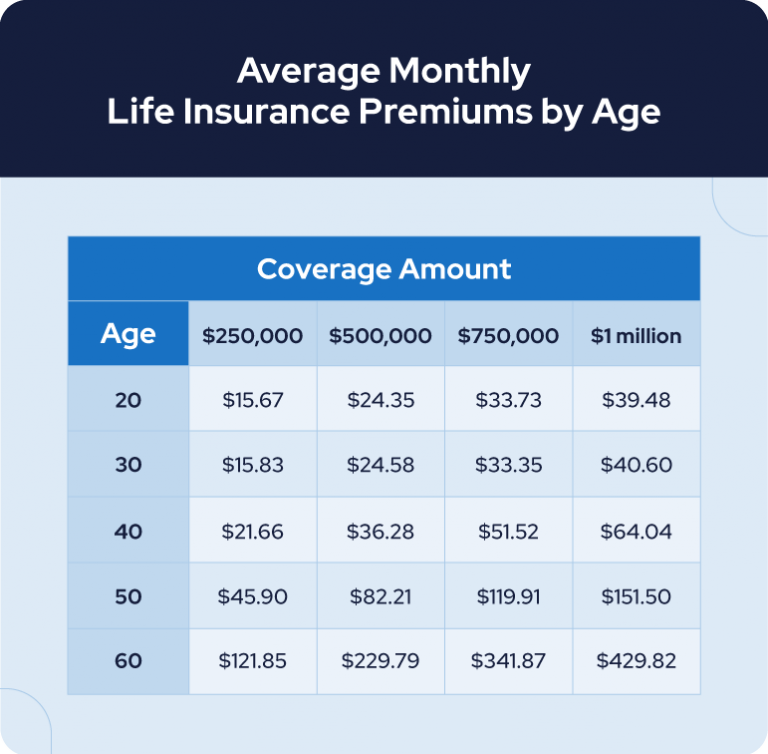

Annual premiums for a 500000 life insurance policy with a 20-year duration will have much more than tripled by the age of 50. Plus it doesnt build a cash value which is a factor that will often drive up the life insurance policy cost. So you pay the lowest amount possible only the cost of insurance to provide guaranteed coverage for life whereas in whole life you pay extra premiums that build up as.

A million dollar policy is. Ad Shop Plans From The Nations Top Life Insurance Providers. So if you make 100000 a year a million dollar policy makes.

30 per month or. Dont sell lapse or cancel until you speak with us. A million dollar life insurance policy is a contract with a face value of a million dollars made between you and the insurance company.

While a 45-year-old will have to pay almost. Type of Policy Term Whole Life or Universal Life. For instance if you dont have any serious health problems and youre a non-smoker a 1 million term life insurance policy with a 20-year term may cost from 40 to 160 per month.

Its worth mentioning that the final cost of such a policy will depend on various. Policy term 10 15 20 25 or 30. We show you how to get the most out of your life settlement.

When you commit to. You can sell your life insurance policy for cash. Monthly rates increase sharply with age.

Its that simple. Ad Fidelity Life Insurance - Life Insurance You Can Rely On. Get a quote online for 500k in coverage today.

Here is a sample computation for a 1 million life insurance policy with. A million dollar life insurance policy provides your beneficiaries with 1000000 tax free payout in the event of your death. Help protect your loved ones with valuable term coverage up to 150000.

A million-dollar life insurance policy may seem more like myth than reality but surprisingly high-value plans arent just for the wealthy. A million-dollar life insurance policy can cost less per month than you might pay for a meal from a restaurant. Getting a Million Dollar Insurance Policy on average women will pay much less for their insurance policies than a man will.

Ad Exclusive term life insurance from New York Life. For example as of 2021 a life insurance quote for a 1 million RAPID ecision Life policy from Fidelity Life. If you can justify the need for that level.

The contract comes into effect when. Using Term Life Insurance as an example a 40-year-old male who is underwritten at the best possible rate class Preferred Plus could expect to pay 30 per month for 1 million in life. Million Dollar Life Insurance Plan - If you are looking for the best life insurance quotes then look no further than our convenient service.

This means investing in a million-dollar life insurance policy is more cost-effective than investing in one with inadequate coverage. Ad 2021s Top 5 Life Insurance Policies. Compare 2021s 5 Best Life Insurance Policies.

Best Life Insurance Canada 2022 Company Reviews Policyadvisor

Buy A Million Dollar Life Insurance Policy On A Budget From 15 Month

Million Dollar Life Insurance Policy Find An Agent Trusted Choice

How Much Does Whole Life Insurance Cost Policyadvisor

How Does Life Insurance Work Forbes Advisor

How Much Is Life Insurance In Canada Average Costs Policyme

How Much Is Life Insurance In Canada Average Costs Policyme

How Much Is Life Insurance In Canada Average Costs Policyme

Facts About Life Insurance Must Know Statistics In 2022 Retireguide

Term Vs Whole Life Insurance How To Know Which One You Need

![]()

Permanent Life Insurance Universal Life Vs Whole Life Vs Term 100 2022 Protect Your Wealth

![]()

Life Insurance Companies Becoming Insolvent 2022 Protect Your Wealth

![]()

Permanent Life Insurance Universal Life Vs Whole Life Vs Term 100 2022 Protect Your Wealth

![]()

Co Operators Life Insurance Review Canada 2022 Protect Your Wealth

How Much Is Life Insurance In Canada Average Costs Policyme

Best Life Insurance Quotes Ontario Dropdead Life Insurance

Facts About Life Insurance Must Know Statistics In 2022 Retireguide